Premium bonds are a unique investment opportunity offered by the UK government’s National Savings and Investments program. Many people have questioned whether these bonds are a form of gambling and it’s a fair question to ask. In this article, we’ll delve into the details of premium bonds and explore whether they are indeed a form of gambling.

Premium bonds are a unique investment opportunity offered by the UK government’s National Savings and Investments program. Many people have questioned whether these bonds are a form of gambling and it’s a fair question to ask. In this article, we’ll delve into the details of premium bonds and explore whether they are indeed a form of gambling.

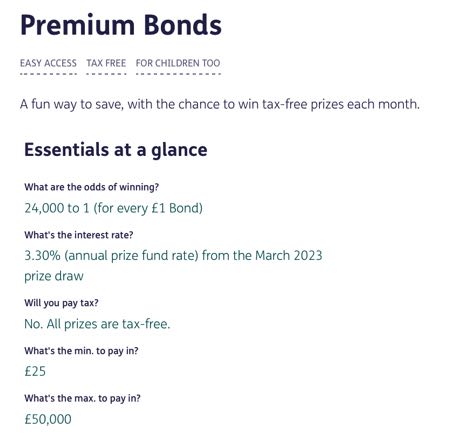

The first thing to consider is what premium bonds actually are. Essentially, they are a type of investment where you buy bonds that are entered into a monthly prize draw. The prizes range from £25 to £1,000,000, and there is no assurance that you will win anything. Instead, you are relying on the luck of the draw to potentially win big. That, in the eyes of many, sounds a lot like gambling.

What Are Premium Bonds?

At first glance, premium bonds do indeed seem like a form of gambling. You are essentially placing your money into a pool, hoping to win a prize. Rather than being a form of gambling, however, they are an investment. The difference between premium bonds and other investment options is that premium bonds don’t earn any interest. It is the chance to win a prize that makes them appealing.

Each £1 that you invest in premium bonds gives you a unique code that is entered into a prize draw. The bonds themselves aren’t worth any more than the amount that you’ve spent to buy them, which is because they don’t accrue interest. As a result, those wishing to make something from premium bonds would be better off investing their cash in a high-interest yield savings account than spending their money on these bonds.

Why They’re Not Like Gambling

There are some key differences between premium bonds and traditional forms of gambling. For example, with gambling, the odds are always stacked against you. Whether you’re playing a slot machine, betting on a horse race or playing poker, the odds are never in your favour. With premium bonds, everyone has an equal chance of winning. In fact, the odds of winning a prize are currently around 34,500/1 for each bond you hold.

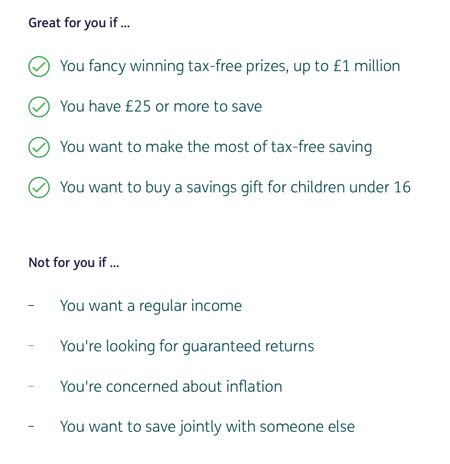

Furthermore, unlike gambling, premium bonds have no negative consequences. When you gamble, you run the risk of losing more money than you can afford. With premium bonds, you won’t end up losing anything. Instead, the bonds will simply sit in your account, secured by the government and ready for you to withdraw whenever you want. You won’t go into debt or suffer any other negative financial consequences if you don’t win a prize.

They’re Not Totally Different

Whilst buying premium bonds isn’t gambling, there are still some similarities between the two activity types. Both involve an element of chance and both can be addictive. If you start buying premium bonds with the expectation of winning big, you could find yourself investing more money than you can afford to lose. That is the same sort of thing that often happens to problem gamblers.

Are premium bonds a form of gambling? The answer is not straightforward. While there are certainly similarities between premium bonds and gambling, there are also some important differences. Ultimately, it comes down to how you view the investment and what you end up doing with your money.

If you see premium bonds as a way to potentially win some money while keeping your initial investment safe, then it’s not really gambling. However, if you see it as a way to make quick cash, then you’re essentially gambling with your money and are unlikely to see a return on your investment.

It is also worth noting that premium bonds can be a good investment opportunity for some people. If you have a small amount of money that you want to invest but don’t want to risk losing, then premium bonds could be a good option. You won’t earn a huge return on your investment, but you won’t lose anything either. This is ideal if you’re looking to save money but aren’t too worried about earning interest on it.

It is important to approach premium bonds with a clear understanding of what they are and what they offer. If you see them as a form of gambling and invest more money than you can afford to lose, then you’re taking a big risk. However, if you view them as a safe investment with the potential for a small return, then they could be a good option for you.

What Makes Premium Bonds Unique?

Premium bonds offer some unique benefits that make them different from other investment options. One of the chief ones is that they are backed by the UK government, which means that your investment is considered to be very safe. Additionally, any prizes you win are tax-free, which can be a significant advantage for some investors.

Of course, all forms of gambling are tax free in terms of winnings in the United Kingdom, so it doesn’t help the argument against premium bonds being another arm of the gambling industry. The key thing to keep in mind is that that premium bonds are not a sure way to get money. If you invest in premium bonds, you could end up winning nothing at all.

In fact, most people who invest in premium bonds don’t win a prize. It’s also important to remember that the prizes are paid out randomly, which means that you could win a big prize early on or you could go years without winning anything. Once again, that is similar to forms of gambling like the National Lottery, where you could win a decent amount with your first ticket or not win anything for a long time.

Why Are You Buying the Bonds?

Another consideration when deciding whether premium bonds are a form of gambling is the motivation behind the investment. Are you investing in premium bonds because you believe in the safety of the investment and the potential for a small return, or are you investing with the hope of winning a big prize? If your primary motivation is the chance to win a large sum of money, then it’s possible that you are treating premium bonds more like a form of gambling than an investment.

Ultimately, the question of whether premium bonds are a form of gambling comes down to personal interpretation. While there are similarities between premium bonds and gambling, there are also significant differences. Some people may view premium bonds as a safe investment with the potential for a small return, while others may see them as a form of gambling with the chance to win big.

What Is Gambling?

If you’re looking to ask a question about whether something is or isn’t gambling, it is probably important to outline what you think gambling actually is. The dictionary defines it as the act of taking ‘risky action in the hope of a desire result’. When it comes to gambling in how most people understand it, as in placing bets on the outcome of certain things, you put your money at risk.

Consider, for example, a bet you might place on a sporting outcome. You are hoping that Liverpool will beat Manchester United in a game of football, so you put £10 on the line with odds of 3/2 that they’ll achieve that. If they do, you win a return, if they don’t then you completely lose your money. In other words, there is a risk that your ‘investment’, which is your stake money, won’t still be yours at the end of the match.

When it comes to premium bonds, that is not the case. Whether you win a prize or not, your ‘stake’ money is still there at the end of the experience. You can withdraw your invested money whenever you feel like it, usually getting it back into your bank account with three business days. You can’t turn around to a bookmaker and declare that you want your stake money back three businesses days after placing your bet if it’s a losing one.

With premium bonds, most of the ‘bonds’ that you own will never see any sort of return in prize money. As a result, you could consider them to be ‘losing bets’ in the sense that you’ve invested the money hoping to win a prize, only to never actually win the prize. Key to that, though, is the fact that the ‘stake money’, such as it is, remains yours. It is almost like a ‘push’ bet in a casino, where it is neither a winner nor a loser.

What Do You Want from the Experience?

One of the most important things about premium bonds is that you are aware that there are some risks involved, as well as the possible benefits. If you’re looking for a safe investment with the potential for a small return, understanding that you may never see any return, that is exactly what premium bonds offer. However, if you’re hoping to win a large sum of money, it’s important to remember that the odds are against you and that there is no assurance of a prize.

One of the most important things about premium bonds is that you are aware that there are some risks involved, as well as the possible benefits. If you’re looking for a safe investment with the potential for a small return, understanding that you may never see any return, that is exactly what premium bonds offer. However, if you’re hoping to win a large sum of money, it’s important to remember that the odds are against you and that there is no assurance of a prize.

It is understandable why some people might think of premium bonds as a form of gambling, but they are not the same thing. Whilst both involve an element of chance, premium bonds offer some unique benefits that make them a different type of investment. It’s up to each individual investor to decide whether premium bonds are right for them based on their own financial goals and risk tolerance.

Investing Always Carries a Risk

When considering whether premium bonds are a form of gambling, it’s also important to look at the broader context of the investment landscape. For many people, investing in the stock market or other traditional investments can feel risky and overwhelming. In this sense, premium bonds can be seen as a more approachable option for those who are new to investing or who want a simpler way to potentially earn a return on their money.

However, it’s important to remember that the potential returns from premium bonds are also lower than what you could potentially earn from other types of investments. If you’re comfortable with taking on more risk, you may be able to earn a higher return by investing in stocks or other types of investments. On the other hand, if you’re looking for a low-risk way to earn a small return, premium bonds could be the right choice for you.

One of the unique features of premium bonds is that they have a sort of built-in savings element. Whilst the odds of winning a prize are relatively low, the possibility of winning a prize can be a good motivator to keep investing. For some people, the chance to potentially win a prize can be a way to incentivise themselves to save more money and to be more disciplined with their finances.

Buying Bonds for Others

It is worth noting that premium bonds can be a good way to invest money for children or grandchildren. Because there is no risk of losing money, parents or grandparents can invest in premium bonds on behalf of a child and know that their investment is safe. Additionally, any prizes won are tax-free for the child, which can be a great way to help them save money for the future.

If you’re considering investing in premium bonds, whether for yourself or someone else, it is important to carefully consider your financial goals and what it is that you’re willing to risk. Ultimately, the decision to invest in premium bonds should be based on a careful evaluation of your own financial situation and goals. With the right approach, premium bonds can be a valuable tool for building wealth and achieving your financial aims, with the added incentive of possibly winning a prize.